Indian Equity market has had long eventful journey. It has witnessed rapid rise and fall in valuation, popularly termed as volatility. The word volatility with respect to capital market can be simply explained as the rate of change in the price of a security. It is very important term for both Investor and trader in the equity market as it always brings an opportunity along with it.

While Indian equity market has displayed short term volatility, it has always offered outstanding valuation gain over long period of time. And hence an investor in Indian market usually has had all the golden opportunity to make money.

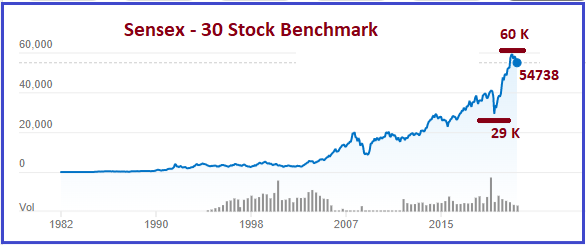

It is since the spread of Covid, Indian equity market has witnessed greater deal of volatility. From all time high of 41500 in Jan 2020, the market plunged to 29000 in March 2020 and leaped to an all-time high of 60,000 Sensex by Oct 2021. And while we write this article (March 2022), the Sensex is close to 53000 levels.

Market analysts were surprised, and Investors are still puzzled at this turnaround after the fall in March 2020. What has driven this rapid rise in Sensex? Is it better covid management or indications of green shoots (better growth prospects of our nation) or huge liquidity?

Among the three-factor cited above, the Liquidity appears to be biggest driver of this bull rally (Bull rally is popular term used for rapid rise in equity market). So, what is the source of this liquidity? It is less domestic and more offshore. Yes, Western economy led by US has created liquidity by lowering their domestic interest rate. With Foreign Institutional Investors (FII) being the largest investors in Indian Equities, this money from the western nations has found its way to Indian capital market. The inflow was huge. This, coupled with the idea of India being seen as an alternative to China, the market rally appears to be logical.

The western world is now worried about their rising inflation (an after effect of high liquidity scenario). They are insinuating at the rise in domestic rate, a phenomenon which is common during high inflationary environment. Some of the recent commentary by Central banker of respective nations are voicing on this line. The very recent Russia and Ukraine war has further brought inflationary trend into global focus with oil price rising rapidly. It is surely an extraordinary situation.

How will it further impact the Indian Equity market and its Valuation? For sure the liquidity driven bias of market seems to be gradually tapering adding to the market Volatility. And this is what we have been witnessing recently. But the depth of decline and the quantum of volatility is always an unpredictable subject.

How should investors react to such an extraordinary situation? We are certain about the market valuation which were on higher than historical average all this while. The moderation of valuation and decline in market appears logical. Though the trigger this time was the geopolitical tensions, one can never be sure about the valuation movement in a volatile market. But regular investment into portfolio (generally SIP/STP route) and periodic rebalancing between asset classes eases the pain in the entire investment process. Rebalancing of portfolio is a skill and may demand the guidance of a financial advisor to make it unbiased.

Capital Market offers opportunities to all investors. But those who identify, understand and act accordingly are the ones who create wealth. Asset Allocation, Investment Discipline, Investment Principle along with periodic rebalancing will help one navigate through market volatility and emerge as successful investor.

Shreedhara is the Founder & Director of Ara Financial Services Pvt. Ltd. He has an experience of over 2 decades in Financial Service Industry with majority of it in guiding individuals and institutions on their investments requirements.