Most of us consciously take many risks in our day-to-day life. We ride a bike, drive a car, travel by aeroplane, eat varieties of food (few classified as junk food) and the list is long. Many of us even migrate to an unknown city, country or even a different continent for work, better lifestyle or even to safeguard ourselves from the situations in our home country for a better future. Wait! Are you thinking what is so risky about these common things? Generations back these were not considered as normal but gradually it became the way of life for us. Knowingly or unknowingly we all got adapted to it and today, we hardly consider these things as risk. In fact, we realised that not taking these calculated risks might leave us behind.

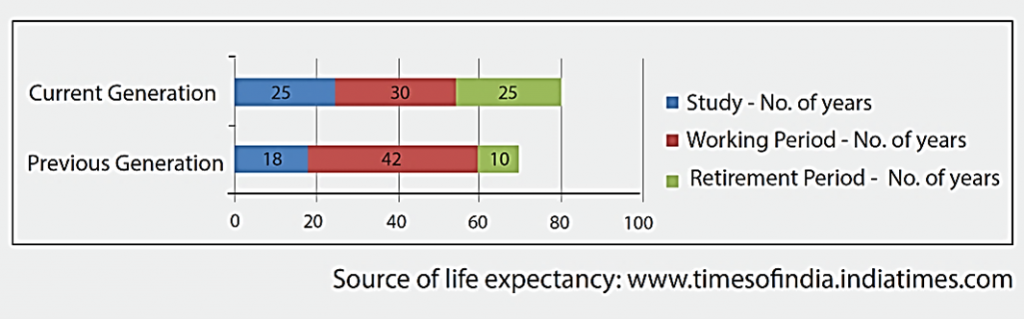

Now, let us look at the below exhibit to understand what else has changed over generations.

The data compares the average life expectancy of two generations and the number of years spent for education, work, and the retirement period. The current generation spends higher number of years for their education and have lesser working years. They also have longer post-retirement years as compared to the previous generation. Thanks to the increasing health awareness and the advancement in medical science, the new trend is going to be the risk of living long. Yes, you read it correct – The Risk of Living Long.

So how does living longer, which is a general blessing that every elder in India gives (read as Ayushman Bhava) be a risk? It simply means, we need more money for a good lifestyle and a stable post – retirement life compared to the previous generation. This, combined with lower fixed income rates, defines the new normal for the current and the next generation also. To top it up, we are also vulnerable to disruptions that technological advancement can bring along like job losses, changing business models etc. We must be prepared mentally and financially to efficiently deal with these risks. Do you feel that the money saved by way of salary, fees or business income alone be sufficient to make us financially independent? How do we ensure that we have enough wealth to take care of our needs? Have we ever thought about all these as risk?

Let us first see how our usual approach has been when it comes to investing our hard-earned money. We have been investing in products like FD, PPF, Gold, Real Estate etc. since time immemorial. Most of us derive comfort and a feeling of safety by investing in these traditional products. Probably because our parents and grandparents have been investing in these since ages. We also have an asset class called Equity which was once regarded as “only for the rich product” and some also regarded it as “gamble”. Even today lot of us consider it as an adventure. Lately, equities have found a share of our wallet through the Mutual Funds route. But surprisingly, even after two decades (and with so much of available data), equities as an asset class does not get the required weightage in investors’ portfolios. This is mainly because we often associate the volatile nature of equity market as “RISK”.

The question that still many of us have is – How to determine how much risk should I take? Well, many organisations follow a method of risk profiling through a questionnaire which quantifies the risk appetite of an investor. The outcome of this is used as a barometer for recommending products to the investor from time to time. This, no doubt, is a well-thought process (at least in the interest of the organisation from regulatory perspective). But does the outcome of risk profiling compliment an investor’s need of attaining financial freedom? What should an investor inculcate for his own good is a million-dollar question. Considering the undeniable reality about the changing life span (as in above illustration), what is the risk that we carry? Is it the product risk, market risk or the risk of not taking any risk?

It is extremely important to understand the extent of risk that we must take to efficiently achieve our goals or grow our wealth. Selecting an investment product according to the time horizon of the investment is a prudent approach. We should choose a low-risk product for our short-term needs (up to 3 years), moderate risk one for medium term (3 to 5 years) and high-risk products strictly for our long-term goals (above 5 years).

Today we have enough data (on Equity Mutual Funds) to understand that the risk of market volatility is high in the short term, but it diminishes reasonably when we stay invested for a long term (above 5 years). Evaluating it with other risks like falling interest rates, inflation, job loss etc., it would be irrational if we are not able to make use of the market volatility for our own long-term benefit. We must learn to accept it as a part and parcel of your investment journey. Just like we follow the traffic rules while driving a vehicle, we need to follow certain principles in investing too. And yes! It is important to take the advice of an expert in these matters.

Our stand: Risk is something which is unknown, is not quantified and is something which is outside of our normal thinking. When it comes to investing in Equity/Equity Mutual Funds, factors like volatility, sudden crash for any reason is the characteristic of the capital markets. This should not be perceived as risk if you are a long-term investor. Since this is the basic nature of this asset class, we should train ourselves to ride this volatility for our financial independence. And in today’s time, not taking this risk will be the biggest risk.

Image by Here and now, unfortunately, ends my journey on Pixabay from Pixabay

Shreedhara is the Founder & Director of Ara Financial Services Pvt. Ltd. He has an experience of over 2 decades in Financial Service Industry with majority of it in guiding individuals and institutions on their investments requirements.