Mutual Funds During Market Volatility can seem unpredictable, unsettling, and, at times, overwhelming. But just as investment experts know how to navigate rough waters, smart investors too can weather market turbulence with the right strategies. In India, where economic and political events can swiftly impact markets, understanding how to manage your mutual fund investments during volatile times is extremely crucial.

Understanding Mutual Funds During Market Volatility

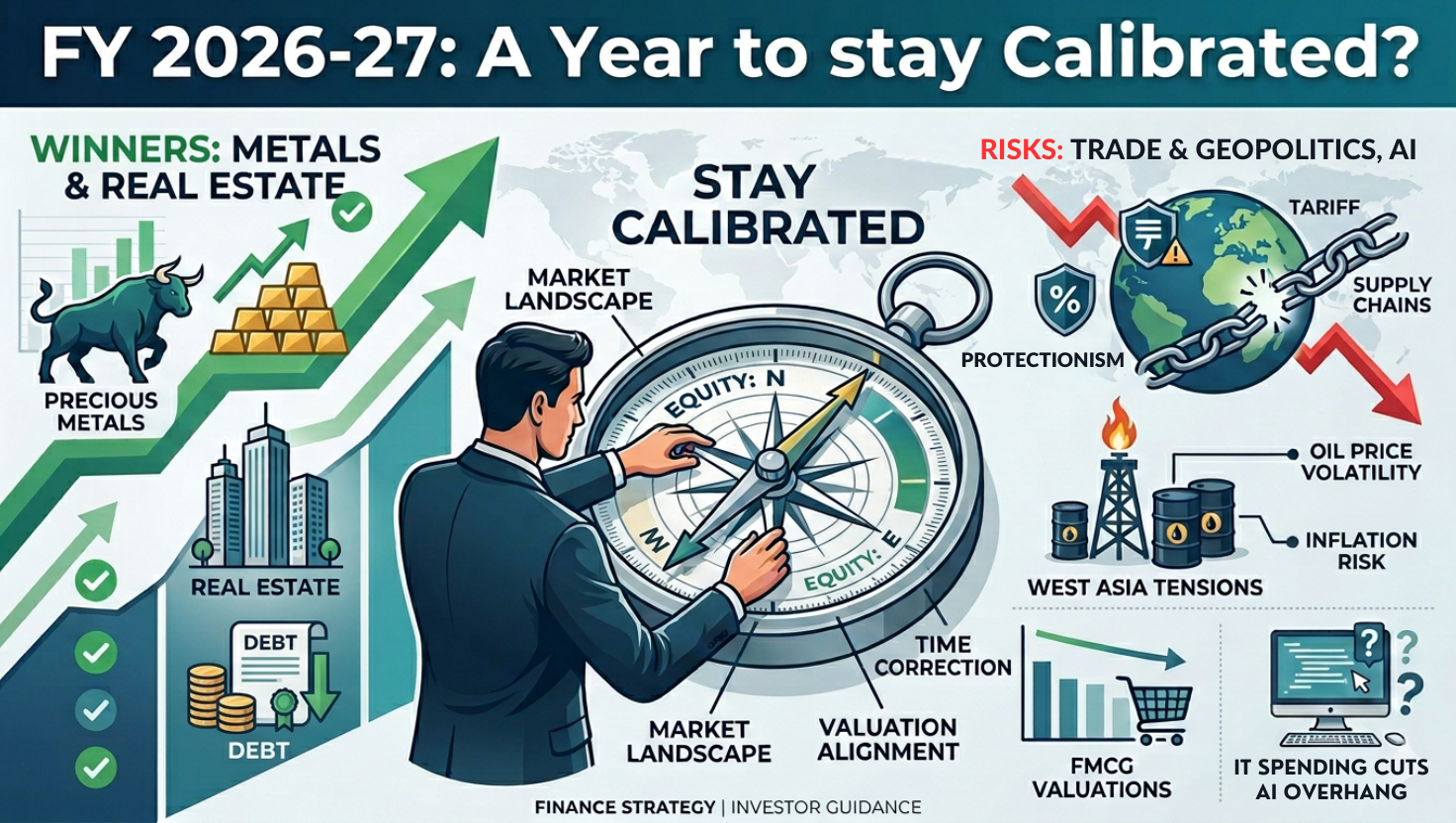

Market volatility can be influenced by a range of factors including economic data releases, changes in government policies, climatic conditions like droughts/floods, geopolitical reasons, global economic conditions, and domestic events like elections or budget announcements. For instance, a sudden change in interest rates by the Reserve Bank of India (RBI) or geopolitical tensions in the region can lead to increased market fluctuations. Understanding these influences can help you anticipate and react appropriately to market changes. However, volatility is an element of the market that helps you make better returns in the long term.

Navigating the Emotional Aspect of Mutual Funds During Market Volatility

When markets swing wildly, it’s easy to get caught up in the emotions of fear and panic. But reacting emotionally is often a recipe for disaster in investing. The temptation to sell off your investments when the market dips can be strong, but it’s important to remember that these fluctuations are quite common in capital market investments and are often temporary.

Key Strategies for Investing in Mutual Funds During Market Volatility

1. Stay Invested with a Long-Term Perspective

One of the most critical strategies during volatile times is to stay invested. The Indian stock market, like any other, has its ups and downs, but over the long term, it has historically provided solid returns. By staying invested, you allow your mutual fund investments the time they need to recover from short-term dips and capitalize on long-term growth opportunities.

2. Diversify Your Portfolio

Diversification is a tried-and-true strategy for managing risk. After identifying the goals, you can spread the investments across different asset classes—like equity, debt, hybrid, multi-asset funds, etc. Diversifying helps in balancing the returns to the best extent and helps you weather the market volatility. For example, during periods of equity market volatility, debt funds, gold funds, or multi-asset funds often provide stability to your investment portfolio.

3. Rupee Cost Averaging: SIPs to the Rescue

Systematic Investment Plans (SIPs) are a powerful tool, especially during volatile markets. With SIPs, you invest a fixed amount regularly, which helps you buy more units when prices are low and fewer units when prices are high, averaging out the cost. This strategy, known as rupee cost averaging, reduces the risk of timing the market and helps you build wealth over time.

In India, SIPs have gained popularity due to their simplicity and effectiveness, enabling investors to start with small amounts and benefit from compounding over the long term.

4. Rebalance Your Portfolio Regularly

Market volatility can skew your asset allocation, making it necessary to rebalance your portfolio periodically. For instance, if equity markets have gone up significantly, the proportion of equity in your portfolio may have increased, which might lead you to reduce the allocation to equity to restore your desired asset allocation. Rebalancing helps you maintain a risk level you’re comfortable with.

5. Avoid Timing the Market

One of the biggest mistakes investors make, especially during volatile times, is trying to time the market – i.e., thinking that you can buy at the lowest market level and sell at the peak market level or before a crash. The truth is, predicting market movements with precision is practically impossible. Hence, investing systematically based on the time horizon of your goals can help you in the long run.

The Role of Financial Advisors in Mutual Funds During Market Volatility

If market volatility makes you anxious or if you’re unsure about the right strategies to adopt, consider seeking advice from a financial advisor. A good advisor can provide personalized guidance, help you navigate market turbulence, and keep your investment plan on track.

Market volatility is a natural part of investing, but it doesn’t have to be a source of anxiety. With the right strategies—like staying invested, diversifying your portfolio, leveraging SIPs, and rebalancing regularly—you can not only protect your investments but also potentially benefit from market fluctuations.

Final Thoughts on Mutual Funds During Market Volatility

Volatility is an element of the market that needs to be seen as a friend which will help you make better returns, if you stay disciplined throughout the journey in the long term. Navigating Mutual Funds During Market Volatility requires a combination of strategic planning, informed decision-making, and emotional resilience. By employing these additional strategies and points, you can better manage your investments and potentially turn market challenges into opportunities. Involving an expert will ensure you stay invested and not take any irrational decisions which can be detrimental to your wealth creation journey. Staying informed, leveraging expert advice, and maintaining a disciplined approach will surely help you further achieve your long-term financial goals even in the face of market uncertainties.