Look at the image closely.

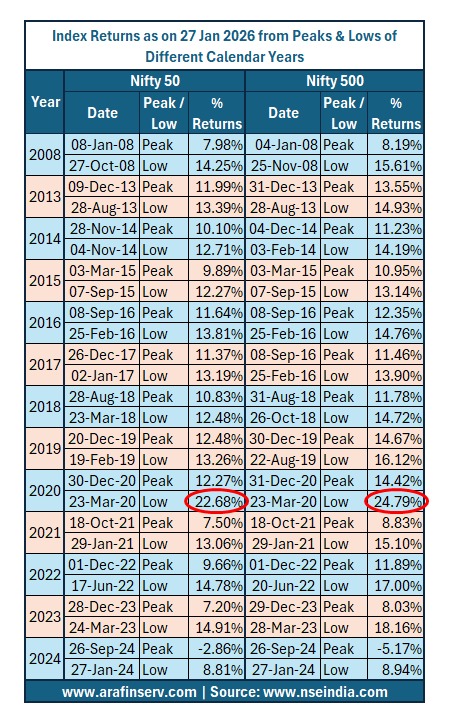

From the COVID-19 lows of 2020 till now, equity markets delivered ~20–25% CAGR. For many NEW investors, this abnormal high return has become their benchmark.

But let’s step back for a moment. From the peak of 2008 (just before GFC) till date, the point to point compounded annual return is in single digit which signifies how the entry level valuation matters a lot.

Since 2008, India’s equity market has grown from a ~ ₹ 20-25 Lakh crore market cap to a ~ ₹132 Lakhs market cap today.

The mutual fund industry has also exploded from a relatively small base to ₹80 lakh crore+ AUM. A big inflection point? Post-COVID.

During the Covid time, people were at home. Opening an investment account became effortless. Investing mindsets changed and a whole new generation of investors entered the markets.

With inflation falling in last two years, returns from fixed deposits became less attractive. Thanks to the social media noise and efficient capital market performance, lot of investors started allocating more money to capital market products.

Returns were strong. Very strong. And honestly, many investors started believing: “This is how markets work.”

And here’s where reality needs to walk in.

Over long periods of 10, 15, 20 years, which is a typical period for long term goals like child’s future or retirement, the equity returns average closer to 10–12% which is aligned with the EPS growth.

The post-COVID phase was extraordinary but not permanent. Though, today we see a 20% plus returns from covid lows even after last one year’s time correction, if the market continues this trend for another 12-18 months, it won’t be surprising to see this 20% average getting aligned with the long-term average returns.

So, ask yourself:

If your financial plan is built assuming 20% long term returns, will it sustain when market reverse back to their long-term averages? (as above data suggests)

Long-term wealth is created by staying invested, managing expectations, and respecting cycles. Not by extrapolating the best 5 years into the next 25.

The market doesn’t punish optimism. It punishes unrealistic expectations.

Shreedhara is the Founder & Director of Ara Financial Services Pvt. Ltd. He has an experience of over 2 decades in Financial Service Industry with majority of it in guiding individuals and institutions on their investments requirements.