With over 20 years of experience in the financial field, I have witnessed countless market cycles and navigated many of my clients through the ups and downs of market, life cycles and job market. Through all these experiences, I have observed a few consistent patterns and practices that make a real difference.

Today, I’m sharing 18 timeless lessons in personal finance with you. Some of these may sound familiar – maybe you’ve heard them before or even experienced them. If you are new to the world of investing, consider this as your zero-cost first-hand guide. If you are a seasoned investor, it can offer reassurance that you are on the right track or nudge you to realign your path.

As I reflect on these insights, I often wish I had received such guidance when I began my journey.

18 Timeless Personal Finance Lessons

- Wealth is built more on behaviour than intelligence. Your mindset matters more than your math skills.

- Maintain an emergency fund that covers at least 12–18 months of expenses.

- Your personal finance depends 99% on discipline and 1% luck.

- Track every expense — yes, even the smallest one. Awareness is the first step to control.

- Make saving and investing your life mantra. Stay the course through life’s ups and downs.

- Stay away from people who promise quick money. If it sounds too good to be true, it probably is.

- Avoid so-called ‘finance helpers’ or financial influencers who push specific schemes, funds, stocks, or companies. They usually have a hidden interest in those schemes.

- Use credit cards wisely, reserve them for emergencies or the convenience of transactions, not for buying on credit. Don’t let convenience turn into an expensive habit.

- Buying on EMI usually means you can’t afford it. Unless it has great utility value, do not fall for instant gratification to buy things you don’t need.

- Spend on meaningful experiences, not flashy possessions.

- Prioritize asset allocation and comprehensive financial planning.

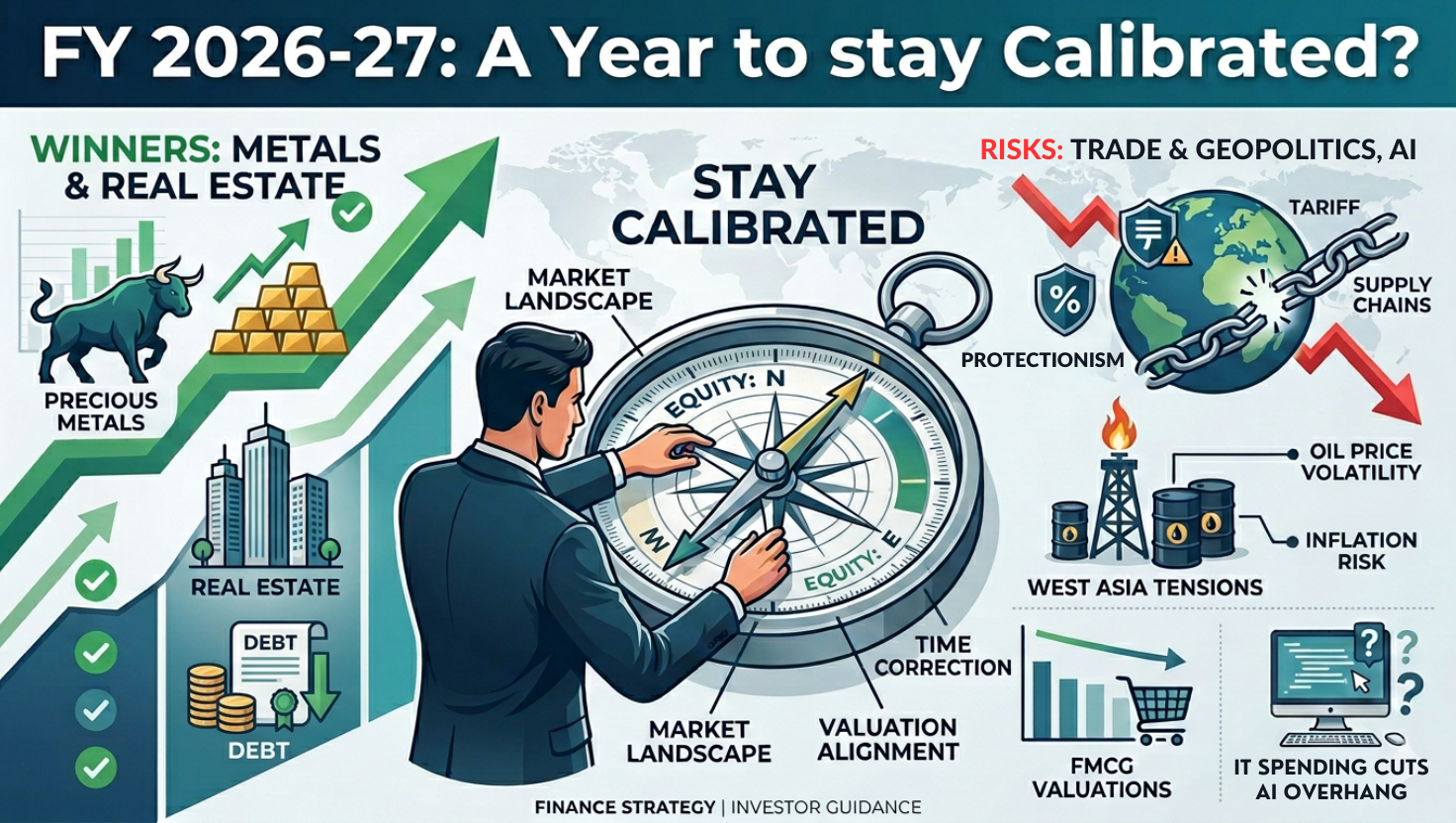

- Follow time-tested investment principles as part of your financial planning.

- Do not select products based on their historical performance. Select products based on your goals and the timelines of your goals.

- Stock picking requires time, expertise, and access to the right information. If you lack these, mutual funds are a smart alternative. Invest through SIPs to build wealth over the long term.

- Build a financial portfolio based on your goals.

Low-risk products for short-term goals, medium-risk products for medium-term goals, and high-risk products for long-term goals

- Don’t invest based on trends, headlines, or hype. Chasing fads rarely leads to sustainable wealth.

- Understand the importance of the power of compounding. Learn, apply and make it work for you.

- Be selective while sharing your personal details like phone number or email ID.

Protect your privacy and your peace. Do not fall prey to scammers.

Final Thoughts

Financial freedom isn’t a dream — it’s a series of mindful choices.

Start applying even a few of these principles, and you’ll be surprised at the difference they can make.

With the right habits and mindset, anyone can build a secure and fulfilling financial life.

Shreedhara is the Founder & Director of Ara Financial Services Pvt. Ltd. He has an experience of over 2 decades in Financial Service Industry with majority of it in guiding individuals and institutions on their investments requirements.

3 thoughts on “Namma Bhatru’s Byte-sized Life Lessons – 18 Timeless Personal Finance Lessons Everyone Should Know”

Very well written, thanks

Very useful for the beginners and reassuring for those who are already familiar with the financial journey.

Normally they say emergency fund should cover 6 months expenses . You have made it 12-18 months. That is a welcome change. You are assured of 1 – 1 1/2 years of smooth sailing.

Overall it’s very good .

Thank you for your thoughtful feedback, Gurumoorthy! We’re so glad you found it both useful and reassuring. Your perspective adds great value to the conversation.