A tailored investment approach is extremely important for every individual/corporate to be prudent and have a comfortable financial position through out. We need to identify and bifurcate our financial goals basis short, medium, and long term to ensure we have a control on it. When it comes to short-term requirements (up to 3 years), we generally tend to incline towards traditional fixed return products. Debt Mutual Funds are one of the mutual fund categories that an individual or institution can consider for their short to medium term requirements. Debt Funds invest in fixed income instruments like Govt. Bonds, Corporate Bonds, Debentures, and many other similar instruments. For an investment need of as low as 1 day to up to 3 – 4 years, there are different funds which can be considered under Debt Mutual Fund category.

For an investment need of less than a week, Overnight Funds are safest suitable option under debt funds. The money is invested in securities with overnight maturity or a day and are backed by collaterals such as Govt. securities. Because of this, overnight funds do not carry any mark to market risk generally referred as interest rate risk. Overnight funds are the best option for institutions to park their surplus funds as the money in the current account doesn’t earn any interest.

Liquid funds, another option for short term, invests money in short term fixed return securities. They are generally considered to be low risk as the investment is done into high quality fixed income securities having maturity of as low as 91 days. The fund is less vulnerable to debt market volatility (due to changes in prevailing interest rate) and this makes it suitable for investment needs of as low as 7 days to even up to a year.

There are couple of aspects which needs to be considered before selecting the right debt fund. Depending on the time horizon, investment objective and the prevailing interest rate scenario, investors should choose the fund that suits their need. Investors can opt between Overnight Funds, Liquid Funds, Ultra Short-term Funds, Short-term Funds and Floating Rate Funds if the investment period is less than 3 years. There are other debt funds like the Corporate Bond Funds, Dynamic Bond Funds, Regular Savings Funds, Credit Risks Funds to name a few. These funds are ideal for investors who can stay invested for a time horizon of 3 years or above. Investors who have a little higher risk appetite and aren’t depending on these funds for any short-term emergency, can consider investing in it provided they understand the working of these funds.

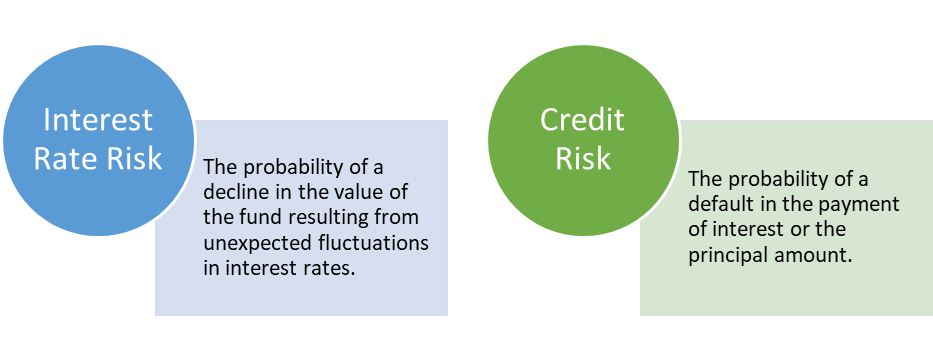

What are the risks involved in Debt Funds?

The purpose of investing in debt funds is to generate a little better return compared to the traditional products. The fund management team take reasonable precautions by selecting superior creditworthy securities and diversifying the investment. Though many of these funds are considered as reasonably safe, they do carry a certain amount of risk. Each fund has a different investment objective. Hence, the risk it carries and the returns it can deliver will vary from fund to fund.

Who should invest in Debt Funds?

Short-term Requirements: Individuals who have an investment time horizon up to 1 year. E.g., Paying school fees, insurance premiums, accumulating for annual vacation/travel, etc.

Emergency Fund: Individuals can build an emergency fund through SIP in debt fund. And for those who have already invested in traditional products can consider investing a portion of it in debt funds for tax efficient returns.

Away from Sight: For a lot of people what isn’t visible in savings account usually isn’t considered for spending. For those who want to have a control on spending can consider investing debt funds.

Savings Bank Account Lovers: Many of us park a reasonable amount of money in our savings bank account. Few debt funds are a tax efficient alternative for such investors.

Investing in Equity via STP: Liquid Funds are often used as a vehicle to invest in Equity Mutual Funds by way of Systematic Transfer Plan (STP). This strategy helps reduce the downside risk particularly during volatile market conditions.

Corporates/Institutions: Money parked in the current accounts does not earn any interest. Also, when the money involved is sizeable, even a decimal change in the returns matter a lot (of course without negotiating on the risk). A Corporate can plan its cashflow and invest in a combination of different debt funds for optimising their overall yield and mitigate the risk of interest rate volatility.

Our Thoughts

Debt funds are ideal for investors looking for

- Reasonable returns with low risk

- Short to medium term investment horizon

- Liquidity of a savings bank or a current account

- Tax efficient alternatives to traditional fixed return products

Most of the time, we leave a sizeable balance in the savings accounts which we hardly use over the years. Since the debt funds are taxed under capital gains tax (as per present tax rules), it makes sense to move a portion of such money to Liquid Funds or Short-Term Funds. Unlike savings account interest, the returns from these funds are taxed only upon withdrawal. And if the investment crosses 3 years, the withdrawals are taxed under long term capital gains with a benefit of indexing it with inflation. This makes it an attractive and tax efficient alternative.

To summarise, Debt Funds can be a prudent option for your short to medium term investment needs. However, the selection of fund should be done after understanding various aspects like investment time horizon, expected returns, risk involved, tax efficiency and the interest rates cycle. Since these factors keep changing, it is suggested to take an expert’s advice to help you decide the best option.

Shreedhara is the Founder & Director of Ara Financial Services Pvt. Ltd. He has an experience of over 2 decades in Financial Service Industry with majority of it in guiding individuals and institutions on their investments requirements.