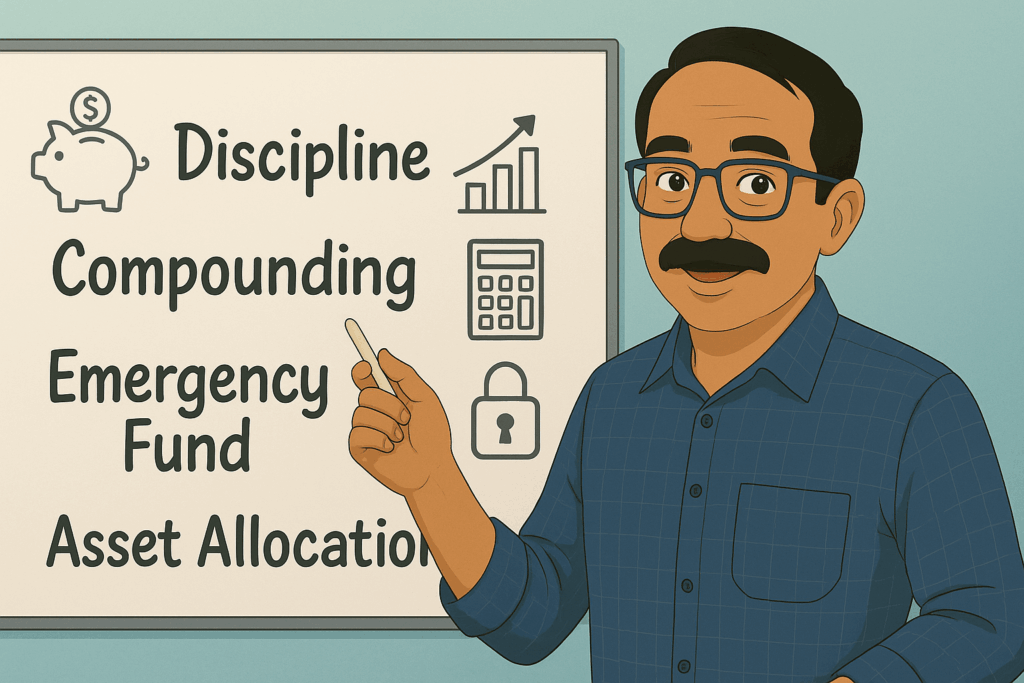

The One Investing Rule You Shouldn’t Break

Markets move in cycles, but one investing rule never changes — disciplined asset allocation. Whether markets rise or fall, sticking to the right asset mix protects your long-term goals and prevents impulsive decisions driven by recent performance.

The One Investing Rule You Shouldn’t Break Read More »