Thanks to the post-COVID economic recovery and increased liquidity, the Indian capital markets have experienced one of their best rallies, supported by strong fundamentals. India’s growth story is undeniable, and we expect this momentum to reflect in the stock markets over the next decade. However, like any market rally, this one also comes with its own set of caveats.

Currently, even the most seasoned fund managers are holding a good part of their portfolio in cash and have been vocal in alerting the investors to be cautious. Warren Buffett, the most sought-after fund manager, is maintaining a sizable part of his portfolio in cash. In India, equity fund managers of most mutual fund companies are holding anywhere from 6-8% to as high as 18-20% in cash. The Securities and Exchange Board of India (SEBI), the country’s capital market regulator, has urged investors to practice financial prudence, maintain asset allocation, and avoid over-investing in products that have delivered extraordinary returns in recent years. SEBI has even directed fund houses to conduct stress tests to ensure that funds can handle redemption pressure in overheated segments in the event of a market meltdown. Sufficient signals to be cautious.

What concerns me is not the market rally, correction or the caution signals, but the heightened return expectations that has been built among investors (many first timers) in the past 3-4 years. The premise for writing this article is one such pattern that I have observed during our client interactions. “Fund A has delivered only 15%-16%, whereas Fund B and C have given 22%-25%. Why cannot Fund A also generate above 20% returns? Shouldn’t we switch from Fund A to Funds like B or C?”

With over two decades of experience in this profession, I have seen different market cycles and how it results in a shift of mindset of investors, including our clients. This shift is despite educating clients while onboarding that 10-12% returns is a fair expectation to have from equity mutual funds portfolio in the long term (8-10 Yrs). However, few funds within the portfolio would have a potential of delivering an average of 14-16% or higher under certain market conditions. Portfolio building is a process and having the right expectations is crucial for successful and peaceful wealth creation journey. If this kind of expectation exists among well-guided clients, I can imagine the plight of new age investors in the DIY space trying to navigate the market on their own along with their job or profession.

In one of our previous articles, “How to Build a Resilient Equity MF Portfolio”, we emphasized that a resilient portfolio should include a mix of funds based on both Growth and Value investing strategies. If you recollect, a few years back the value investing was out of flavour, as growth stocks had been performing exceptionally well and were every investor’s favourite. The prevailing investor sentiment back then was: “There’s no value in value stocks as there’s no growth.” Many investors wanted to switch from value-oriented funds to growth-focused ones, purely because of the superior returns they had delivered. We advised against such switches, noting that value stocks would play their role when the time is favourable for these stocks.

Fast forward to today, and funds following value investing strategy have performed exceptionally well in the last couple of years. Growth stocks, on the other hand, haven’t fared badly, but in many cases, their price-to-earnings (P/E) ratios have come down, keeping their prices subdued. This has caused some of the top-performing funds back then to appear less attractive now. Times may have changed, but investor behaviour hasn’t. We now caution against jumping ship just because value stocks are outperforming. Switching strategies based on recent

performance alone can be disastrous as investors carry a risk of missing out on returns from both sides.

Today, similar caution applies to the mid and small cap segments which has seen extraordinary returns in past few years. Like the combination of value and growth strategy, a portfolio should also have a right mix of large, mid and small cap funds. The combination of surge in new investors, higher liquidity and the desire for quick higher returns has driven significant money into mid and small cap funds (which prompted SEBI to ask fund houses to do a stress test). This has also shaken the belief of a lot of DIY investors who felt that investing in Nifty 50 is the best strategy. Managed funds have managed to beat the index funds decently.

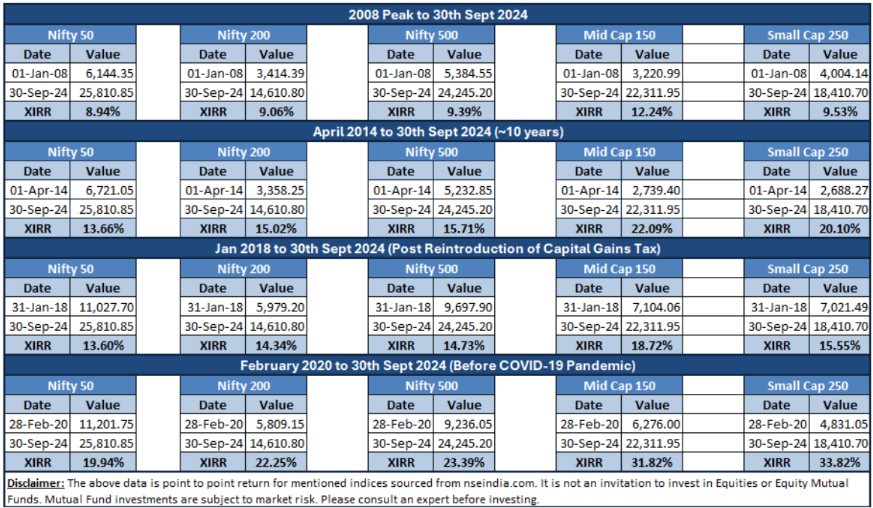

Coming to the point where I always stress that investors should have a long-term approach while investing in equities. Let us look at the returns data of different indices as of September 30, 2024. I have segregated it across four different timeframes to understand how they have fared considering different time horizons as mentioned below:

One thing is certain that in the long term, markets are slaves of corporate earnings. Though there is some divergence, the returns have been fairly in the range of 12% – 16% on an average. The data also highlights the irrational exuberance of the last 3-4 years skewed long-term averages as on date. While switching funds for better returns may seem logical, it can often be the most irrational decision in the long run.

Like all market cycles, this pattern will change over time. Avoid the temptation to chase returns. Building wealth via investing demands highest level of patience. It is essential to stay calm, plan your finances carefully, maintain financial discipline, follow sound investment principles, and stick to your asset allocation strategy.

Shreedhara is the Founder & Director of Ara Financial Services Pvt. Ltd. He has an experience of over 2 decades in Financial Service Industry with majority of it in guiding individuals and institutions on their investments requirements.